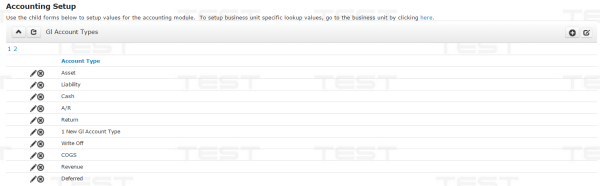

G/L Account Types

The G/L (General Ledger) Account Types categorize accounting transactions. A G/L Account needs to be labeled and set up for every type of these transactions.

|

Product Setup — G/L Accounts

When setting up any product in netFORUM, you need to choose what G/L accounts are related to it. The different accounts you choose determine the transactions that will hit your General Ledger, so it's very important that you choose the correct ones.

Please note that the every G/L account you create also has an account type. This account type is used in conjunction with a system option to determine what shows in each of the G/L account drop down lists during product setup.

Usage

If you are setting up a site for a client for demo purposes, here's a list of some typical account numbers:

| G/L Account Code | Description | Account Type |

|---|---|---|

| 1000 | Cash | Cash |

| 1100 | Valued Inventory | Inventory |

| 2000 | Account Receivable | A/R |

| 3000 | Unapplied Payments | Liability |

| 3100 | Deferred Membership Revenue | Deferred |

| 3200 | Deferred Event Revenue | Deferred |

| 3300 | Refunds Payable | Liability |

| 4000 | Membership Revenue | Revenue |

| 4100 | Event Revenue | Revenue |

| 4200 | Product Revenue | Revenue |

| 5000 | Write Off | Write Off |

| 5100 | Cost of Goods Sold | COGS |

Account Types

- A/R Account

- This account is debited every time your product is sold. Even if your association operates on a cash basis and you only create proforma or prepaid invoices, the a/r account on your product is still debited when you sell the product (note that proforma invoices are not released to your g/l until a payment is on the invoice). For this reason, it is important to create and choose an actual A/R account (even if it is a dummy account that you don't really use). The A/R account is credited when a payment is made, when the invoice is written off, or if the invoice is canceled before payment is received.

- Revenue Account

- If you have not checked the 'deferred' checkbox for this product, this account is credited when your product is sold, and debited when you void an invoice in a closed batch. If you have checked the 'deferred' checkbox on the product, it is not credited until you run the recognize revenue process for the period in which the 'recognize after' date for the product is included.

- Liability Account

- This account is credited when a paid invoice is canceled. This credit resides on the customer's record, where it can either be applied to a different invoice, or refunded. The liability account would be debited when either of these actions is taken.

- Return Account

- This account is debited when an invoice is canceled. For most associations, the return account is the same account used for the revenue account. However, if you track cancellation expense instead of just reducing your revenue, it would be an expense account instead of the revenue account.

- The Deferred Account

- This account appears only if you check the 'deferred' checkbox. If a product is deferred, the deferred account is the one that is credited at the time the product is sold. This account is debited when the recognize revenue process is run for the appropriate period.

- The Write Off Account

- This account is debited when a write off is created.